Abatement of Penalties & Interest

Need Tax Help for IRS Abatement?

Call Now – Free Consultation 866-477-5291

In spite of what you may have seen on late night TV ads, JG Associates knows that the IRS hasn’t suddenly become kinder, gentler and more reasonable for penalty abatement. For instance, the IRS still looks very closely at requests for abatement of penalties and interest.

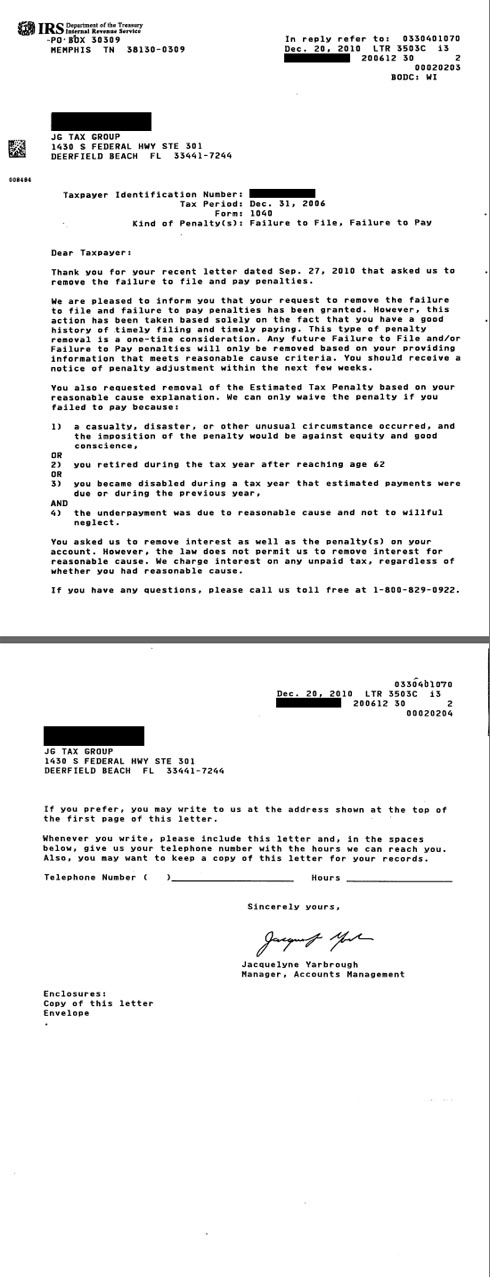

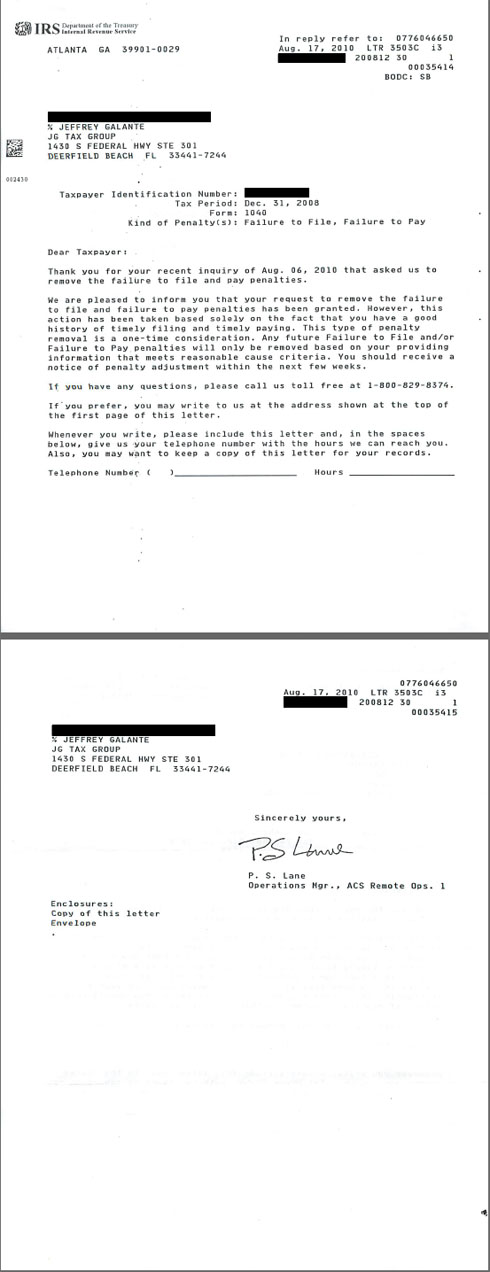

At JG Associates, we submit a petition for an abatement of penalties and related interest on your behalf as soon as we’ve resolved your tax problem with the IRS. Requesting an abatement of penalties and interest isn’t just about sending a simple letter to the IRS. After all, the letter needs to be tailored to your unique set of facts and circumstances.

The good news is that the IRS reviews these requests on a case-by-case basis. Our abatement request won’t be denied merely because your situation is somewhat similar to other taxpayers who have had their abatement requests rejected. Although we can’t guarantee a positive outcome concerning our abatement request, we do everything possible to prepare and submit the best package. We also do everything within our power to reduce your overall tax debt.

Below are two examples of how we have successfully reduced clients’ debts by submitting proper requests for penalty and interest abatement.