Currently Not Collectible? Get Tax Help

Call Our Tax Lawyers Now – Free Consultation 866-477-5291

What can you do, if you can’t afford to pay the IRS?

One of the ways to get out of paying off your tax debt is to be declared “currently not collectible” with or without a tax attorney. The IRS can declare you as being “currently not collectible” after they review evidence that you have no ability to pay the taxes you owe. As soon as the IRS determines that you cannot afford to pay any of your tax debt due to economic hardship and declares you currently not collectible, they must stop all collection activities, including levies and garnishments.

While you are in the “currently not collectible” status, the 10-year statute of limitation on tax debt collection continues to run. If the IRS cannot collect the tax you owe within the 10-year statutory period, then your tax debt will expire and you’ll owe nothing to the IRS. A taxpayer facing significant hardships or tax debt burdens should seek the advice of a tax professional specializing in resolving IRS tax debts.

At JG Associates, we have an excellent track record in resolving collection activity. We can negotiate with the IRS for you to have them agree to stop their collection actions. You will not be required to send them any money until you can afford it. JG Associates will successfully stop the IRS from sending you those nasty collection letters, and you won’t have to worry about the IRS taking your salary, bank account, car or your home.

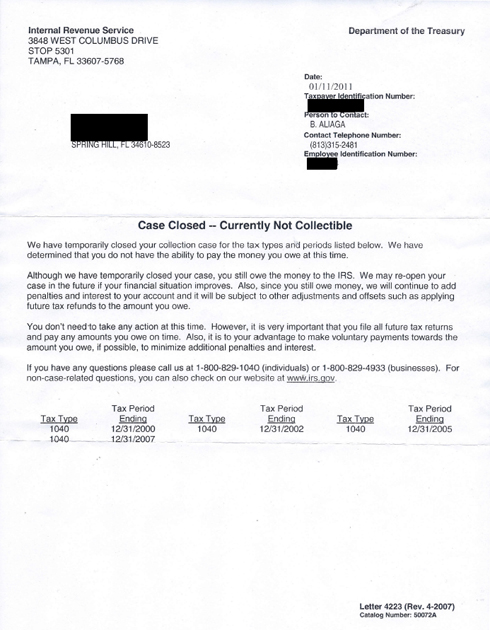

Success Story 1

This client came to JG Associates with wage garnishments and bank levies. He had failed to file individual and business tax returns for four previous tax years. After JG Associates prepared his returns, the client owed the IRS approximately $50,000. When he notified us that he had mailed the returns, JG Associates contacted the IRS and had the client’s debt declared “currently not collectible.”

Client Testimonial

David,

Thank you for the outstanding work! You have done everything you said you would for us and it all went as you predicted. I am absolutely thrilled at the outcome. Every person in your office that I have had contact with has been there for me every step of the way. They are all professional, helpful and friendly. I’ve had no direct contact with the IRS, as you handled it all. Your group made me feel right at home. They are all pros. Thanks!

Success Story 2

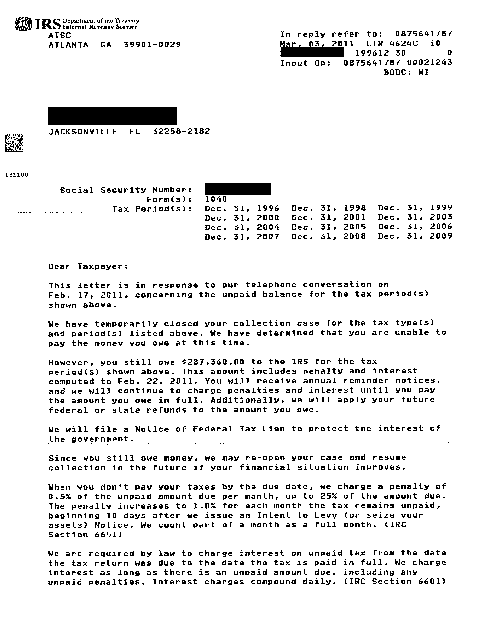

This client came to JG Associates with unfiled taxes going back to 1996. JG Associates assessed the situation, contacted the IRS, and was able to get the client declared as ‘currently not collectible’ on their $287,360.00 tax debt.

This client came to JG Associates with unfiled taxes going back to 1996. JG Associates assessed the situation, contacted the IRS, and was able to get the client declared as “currently not collectible” on their $287,360.00 tax debt.

Client Testimonial

Dear JG Associates,

Your goal has been accomplished. I feel like I got control of my life back. I just opened my CNC letter (see attached) and am sitting here with an enormous grin on my face, which may last for days.

Although I know I’m not completely out of the woods yet, it sure is a good feeling to have a little sunshine on my face regarding this matter. I would like to extend a very grateful and heartfelt “Thank You” to everyone at JG Associates for a job well done.